I think that the term I hear the most often when a recruiter calls me for a CFO opportunity is that their client is looking for a “strategic CFO”. I also see a lot of articles in Finance trade press on the importance of being strategic or on the new CFO that goes beyond the traditional roles of the CFO.

I’ll start by saying that many of the definitions used by those articles of a “traditional CFO” are quite narrow and probably apply to a Controller or Head of Accounting more than that of a typical CFO. I can forgive that, it makes for a more likely to be read article if you are claiming to provide some new insight, but I do find many of the articles to be shallow and they often do not seem to understand what a CFO has always done.

Quite often one of the main things claimed to be needed to be a strategic CFO is to be forward looking. That is probably the claim that puzzles me the most. Even basic accounting and reporting needs to be forward looking because the very basis of accounting for most companies, that they will continue as a going concern, requires forward thinking and analysis. Preparing budgets and forecasts is a core Finance skill. Some are better than others at building relationships outside of finance and get better insight, but that skill is a basic finance skill. Finance usually sits in the middle of the information flow for any company because Finance monitors cash flow, so building relationships is even easier. So I don’t think being forward looking alone makes a CFO strategic.

Other articles encourage CFOs to go beyond the traditional Finance work areas. This is also somewhat puzzling advice for a CFO because is seems to be part of their job to begin with. A CFO is a member of the senior leadership team and often one of the main outside and inside faces of management. Most of us have worked with a variety of functions as we moved up the ladder earlier in our career. A few of us even came over from other functions and hopped over to Finance.

With all of that good experience, trying to run other functions can be disruptive to the team. Everyone already has one clear boss, the CEO. They really do not need another boss. A good CFO will keep the company accountable to the goals everyone is shooting for, especially the financial goals, but be someone that enables success, not trying to run everything and make some sort of success themselves. You’re often in the role of risk control and doing reality checks if goals are being missed, so the CFO is often trying to overcome the bearer of bad news role that is natural to them.

This type of advice varies with the size of the company and what stage it is in, of course. In a smaller, earlier stage company, the CFO (if they are even called that) often have all of the admin functions under them. It is not uncommon for IT to report to the CFO as well. However, as a company grows and becomes more mature, you typically have several clearly defined functional heads. The CFO role usually gets more complicated as well, first with VC fund raising or with investor relations if the company is public. Treasury and fund raising consumes a lot of time as well. So there is limited usefulness in trying to do every function under the sun while CFO. A well structured expansion of roles can work well as part of career progression towards becoming CEO. I don’t think it is the best option when that is not the case and even when it is the intent, the CEO must back it and be clear about why it is happening.

That does not mean that the CFO cannot be deeply involved in areas outside of Finance. You can help the sales team close deals and reduce currency risk via hedging and ensure smooth revenue recognition by getting the contracts right day one. That only happens when you have a good working relationship with that team. You can help Purchasing in negotiating contracts with suppliers. CFOs make excellent bad cops and you might be able to bring financing contacts to the table that can ease the pain of pushing out terms. You are usually the natural ally for IT and the Legal department. Your COO will probably greatly appreciate any help you can give to drive down costs and help in choosing a location for a new plant. CFOs are often made the leaders of large, corporate-wide initiatives, so there is plenty of opportunity to lead teams with other functions under you.

All of these sorts of activities will make you a better CFO. You will make better informed decisions and your team will also make better informed decisions. Communication will increase and improve. You certainly will be much better regarded and that will make difficult tasks easier. So I suggest that you get out of your Finance department comfort zone and expand your horizons. When you complete that big, strategic M&A , you will be able to integrate and get synergies much easier because you work better with all your company’s functions.

I don’t think all of this will make you the “strategic” CFO your boss and the Board is looking for. You’re probably a pretty good CFO but somehow might be missing the “strategic” designation.

I think to have a proper understanding of what is meant by strategic, you need to go to the root of the word and then go from there. From what I can tell from some quick research, the use of the word strategy in a business context only became popular sometime in the 1960’s. Until then, it was meant only in the context of war. The root is a Greek word that means General or battle leadership.

Wikipedia has a good compilation of the meaning of strategy, from a pure definition standpoint to several noted military strategists and writers such as Carl von Clausewitz and B.H. Liddell Hart. The definitions can be boiled down to using all available and appropriate military resources to achieve political goals.

Sun Tzu said in The Art of War “If you know yourself and you know your enemy, you will not lose one fight in a hundred.”

I prefer Miyamoto Musashi’s discussion of strategy in his Book of Five Rings. His Earth Scroll (the first of his 5 scrolls) contains a long discussion on strategy. He even discusses strategy in business (in the 16th century, well before the 1960’s commonly described as the beginning of using strategy in business):

“In the way of business, there are cadences for making a fortune and cadences for losing it. In each way, there exist different cadences. You must discern well the cadences in conformity with which things prosper and those in conformity with which things decline.”

That is quite a profound statement by someone who was mainly known as a sword master. He tells his readers that a businessman needs to see the rhythm in their business and when you can prosper and when you would tend to decline. If you think about it, the CFO sits in the middle of everything as cash converts to reporting and is analyzed. That gives you the base for understanding the cadence of your business, but only by going outside your own department will you fully comprehend the cadence as numbers tend to lag reality. They are easier to see patterns in, but getting in front of the patterns normally comes from something more outward looking like Sales or Purchasing. So it is not being multi-disciplined or leading many departments that matters, it is understanding the rhythm of your business and when you need to act.

Musashi lists 9 things to keep in mind when trying to be strategic:

“

1. Think of that which is not evil.

2. Train in the way.

3. Take an interest in all the arts.

4. Know the way of all professions.

5. Know how to appreciate the advantages and disadvantages of each thing.

6. Learn to judge the quality of each thing.

7. Perceive and understand that which is not visible from the outside.

8. Be attentive even to minimal things.

9. Do not perform useless acts.”

I think these are all very valuable if you want to be a strategic CFO. He again stresses the need to keep a broad mind and not just learn sword fighting (finance in our context), not to do evil or useless things, and pay attention to details and learn to look beyond just the outside. I find the instructions to not think of evil things and not to perform useless tasks to be advice that all leaders should consider. Don’t step over the legal or moral line when plotting strategy of the consequences may derail all the company’s plans and you will put yourself and your career in jeopardy. Don’t do useless busywork, spend your time on actions that add value.

Musashi’s advice to learn the ways of other professions was meant more in the 4 professions framework he used (warrior, the peasant, the artisan, and the merchant) but in his own life he certainly farmed and mastered several arts himself. He was a big believer in doing instead of just reading or thinking about something, and he thought that the path to master the way of strategy was not just by becoming good at fighting with a sword. It was a primary activity, but not the only one. I first read his book when I was in my late teens when I first started sword fighting, and it is an excellent book to help make you better at that. However, once I finished school and started my career, I found his advice to be much broader than just sword fighting and he intended it to be broader.

In the context of a large company, Musashi gives good advice on strategy as well:

“Regarding grand strategy, you must be victorious through the quality of the people you employ, victorious through the way in which you utilize a great number of people, victorious by behaving correctly yourself in accordance with the way, victorious by ruling your country, victorious in order to feed the people, victorious by applying the law of the world in the best way. Thus it is necessary to know how not to lose to anyone—in any of the ways—and to firmly establish your position and your honor. That is the way of strategy.”

He makes it clear that you can take knowledge of individual combat and apply it to larger fights, but you cannot rely on just your individual victory. Rather, you need to take the same foundation you developed to win a sword fight yourself, against one of more enemies, and then use the greater resources your army gives you to win a bigger fight. If you are good yourself, think of what you need others to do to leverage your strengths and their own strengths. He says you need good quality people and then you need to lead them well.

Musashi says “It is necessary to know ten thousand things by knowing one well. If you are to practice the way of strategy, nothing must escape your eyes.”

His advice goes back to this theme quite often. He tells you to see, not just look. To understand and use your understanding in a broad way.

“You should not have a predilection for certain weapons. Putting too much emphasis on one weapon results in not having enough of the others. Weapons should be adapted to your personal qualities and be ones you can handle. It is useless to imitate others. For a general as for a soldier, it is negative to have marked preferences. You should examine this point well.”

With this advice, Musashi tells us that we should not have only one weapon or way to solve problems and not just to blindly copy others. He tells us to be versatile and open to what is the best technique for the problem in front of us. Far too often a CFO will try and use numbers to win, and sometimes it takes something different than numbers. Even if you don’t like leverage, borrowing money might be the right thing to do.

Finally, Musashi makes it very plain what the purpose of strategy is, to win.

“Generally speaking, when people contemplate the heart of warrior thought, they consider it simply a Way in which a warrior learns to be resolute toward death. But this is not actually the essence of the Way: what distinguishes the warrior and is most basic in the Way of the Martial Arts is learning to overcome your opponent in each and every event.”

“The true Way of swordsmanship is to fight with your opponent and win.”

“Your real intent should not be to die with weapons worn uselessly at your side.”

If you want to be a strategic CFO, you must be able to help or make your company win. There are no shortcuts or avoiding this. You may not have to leave your opponent on the ground bleeding to death or already dead like Musashi did, but you do need to win.

Business can be very black and white. There are winners and losers. No company consistently wins over time without the right strategy and culture. I will address company culture in a blog in the future, but the management team needs to be able to develop a winning strategy and execute on it.

I think there is nothing more that you boss hopes for more from his CFO is for them to help him be a winner. No one likes to lose, so the basic risk control and proper reporting skills of a good CFO are appreciated, but not losing is not necessarily winning. A winning strategy might be to survive a down cycle, to understand the market cadence that says you cannot prosper right now so you save resources for when you can, but more often winning is marshaling your internal resources and leveraging the external resources you have available to you.

Musashi says the heart of strategy is winning. He says to fight with what you have, not to leave weapons unused. No company is limited to only Finance tools. A strategic CFO knows how to enable or lead other functions when they are needed to win.

Assuming that you agree with me that the heart of strategy is to win, then you might be wondering what you can do to become a strategic CFO and to become a winner. I can tell you that I personally am not 100% sure how to answer that question from my own experience. I have done well at the various companies I have worked at and in all cases we grew and won. However I know that I am still on the path, I have not arrived at the destination. I do think that the advice that Musashi gave on this is quite good.

“See to it that you temper yourself with one thousand days of practice, and refine yourself with ten thousand days of training.”

When you are not doing, you need to be practicing. Develop skills, develop staff, debate and fight practice battles with your team and the senior management team. Experience helps. When the moment comes to execute and you need to make a decision that leads to victory, if it is something you have practiced or at least thought of in advance, then you will be quicker to act and more likely to make the right choice. Even practicing choosing helps.

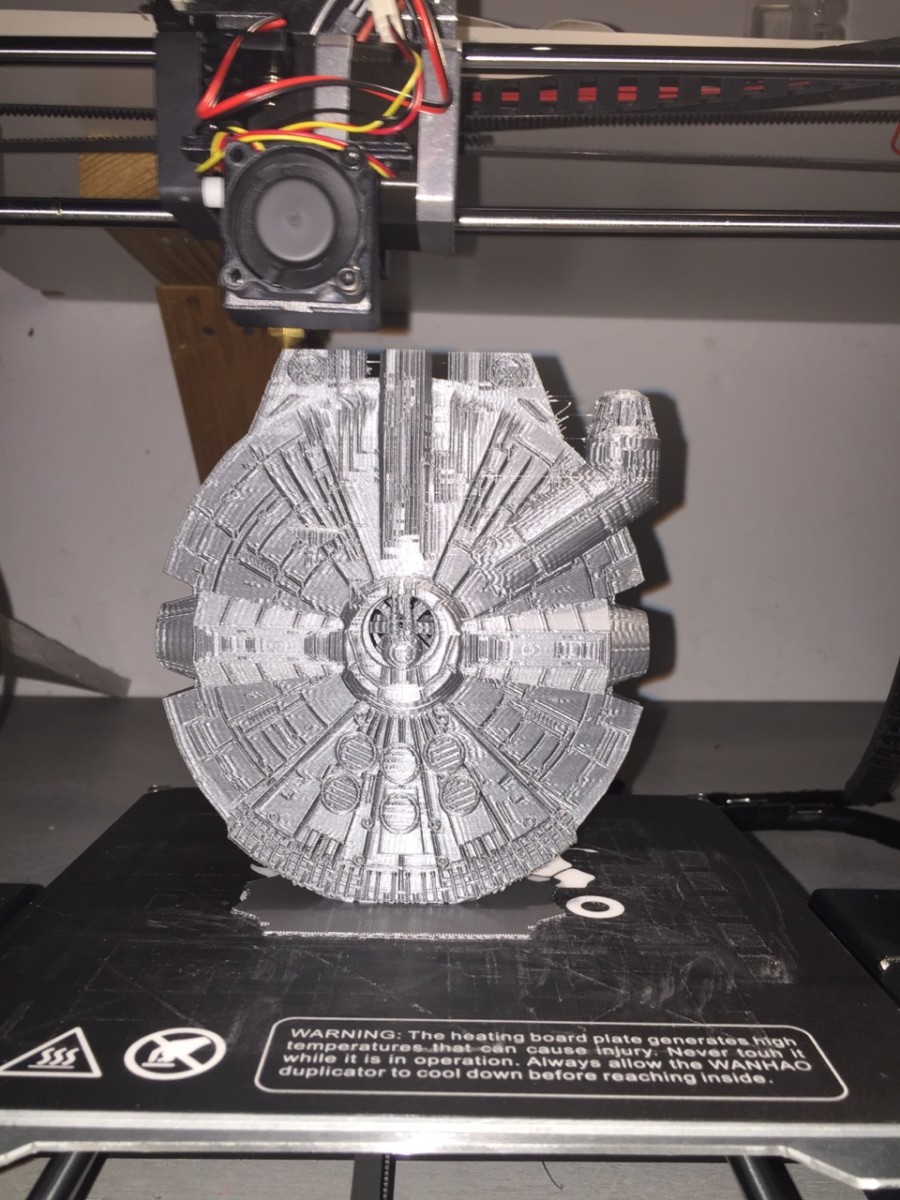

This has just been the broadest overview on what strategy is and how you can use that understanding to be more strategic in your career. I plan on delving deeper into this topic in future entries in my blog and try to use some specific actions and examples I have encountered in my career. For those that care about my hobby posts, I will also go deeper into Musashi and how his book can make you a better sword fighter. I have a few other topics I want to discuss first, but feel free to contact me and ask to move up these discussions.

Strategy Books (all of which I personally own or have visited)

Website with an online, free copy of The Book of Five Rings

The Book of Five Rings

Books, either in paper or on Kindle (all links go to Amazon.com)

The version I quote here:

The Complete Book of Five Rings

The Complete Book of Five Rings – Kindle version

The translation I first read

A Book of Five Rings: The Classic Guide to Strategy

A Book of Five Rings: The Classic Guide to Strategy – Kindle Version

An account of Musashi’s life

The Lone Samuari: The Life of Miyamoto Musashi

Fictionalized versions of Musashi’s life

Musashi

Musashi – Kindle version

Samurai Trilogy [blue-ray]

Responding to a comment letter from the SEC

By Michael

On February 16, 2016

In Accounting and Reporting, CFO

Comment letters are a lot more common. You can expect that your filings will be reviewed every 2-3 years and every special filing you make (like an S-1) will draw a comment letter every time. They are common, and the typical result is improved disclosure the next time you do a filing. A bad outcome is the need to restate which can have significant personal and valuation of the company repercussions. A disaster is a Wells Notice and a full legal investigation.

When I first started, responding to a comment letter was much more difficult and you needed to rely much more heavily on your auditors and your lawyers as they had many examples of responses from their client base and you typically had nothing except for anything you had done yourself or within your company in the past. Ever since the SEC made comment letter responses available online, you should be much more capable of answering them yourself or with a lot less help from your outside advisors.

Here is my general advice on what to do when you receive a comment letter.

As a general comment, you are dealing with very experienced accounting and legal professionals at the SEC. The team that reviews filings and comments on them tend to be very experienced accountants and lawyers who read and comment on filings for a living. Their letter is reviewed by even more experienced staff before it is sent to you. The SEC monitors trends and usually every year there are specific areas of accounting and disclosure that get extra questions for just about every filer that it applies to. Unless you do actually have a very severe issue, there pretty much is no intent to “get you”. I have found 100% of the SEC staff I have worked with over the years to be professional and courteous and generally helpful where they can be helpful. They tend to be pretty flexible where they can be.

Expect an iterative process. There was one pretty long letter that I responded to that the SEC accepted all my answers the first time, but usually is takes 2-3 rounds of replies with more questions.

The first thing you need to do is read it through at least once. You don’t need to fully understand or do any deep research at this point, but make sure that you and your Controller have read the comment letter and have a general idea of what is in it and what the main questions seem to be. You will be very quickly involving others in the process, and they will be relying on you, so make sure that you know how serious the letter appears to be. It usually is pretty easy to identify the most important questions, as the examiner normally makes them pretty clear. There might be a question or two that are trickier and if answered the wrong way will cause a spiral into more questions and a much higher chance of restating.

Now inform your boss and the audit committee. This should be done quickly, your process of reading and getting a general understanding should not take long at all and you need to treat every comment letter with a sense of urgency. It is a good idea to inform your lawyers and auditors immediately and I advise that you copy legal counsel on your communications where appropriate as it is possible that the comment letter will result in legal action against your firm or you personally. The SEC does not allow you to use them as a direct legal defense and your work on replying to a comment letter can be discoverable if not protected. If you are not sure what that means and how to protect yourself and your company, seek legal advice.

I always have a very strong sense of ownership of what we file. I have always found that my reporting is better after I get and respond to an SEC comment letter. You will be engaging and using outside help, but you own the comment letter responses just like you own the filings you did. Do not allow the outside advisors to take over the process. They are not always on your side. If something needs to be restated, or if more serious issues come up, they may also have the agenda of protecting themselves. Remember that auditors commonly get sued as well if accounting issues come up from an SEC review. That means that they are very much on your side until they are not. Chances are pretty good that it will not be an issue but do remember that they have their own priorities and that may mean protecting their business just like you are trying to protect yourself and your company.

Now that your boss and the Audit Committee are informed, you should have also formed a small team to actually answer the comment letter. You need to divide up the comments and delegate them to the people best able to answer the questions (and this may be you). Personally, I think the company should write the first draft of all the responses but you may not have the expertise. If you do not, remember it because you have a skill set hole in your company that may need to be fixed later after the comment letter process is done.

Now that the SEC has made other comment letter responses public, you should be able to find the same questions answered by other companies. There is no rule against using other responses word for word. No such thing as plagiarism or copyright when reviewing SEC submissions. If you check competitors or similar companies and they have identical questions, then you know that those questions are focus areas for the SEC this cycle. Look at the answer(s) that the SEC accepted in the past and consider if the same answers or something very close also applies to you.

I cannot emphasize this enough. Prior SEC filings are a huge resource and you should absolutely use them to guide your answers. There are no prizes for brilliance and answering every question yourself with completely original answers.

Dire warnings aside about making sure you understand the risk that outside advisors may have their own agenda, your auditors are a very good resource. If you are using a Big 4 firm, then their SEC advisory group will have people that recently worked at the SEC. They probably have other clients who have received comment letters from your examiner and have more personal read on his or her style. When it comes to very technical accounting questions, your technical partner can be a big help in drafting a response that cites the correct and most compelling parts of GAAP.

I personally like my responses to be direct and to the point. Sometimes your advisors like to toss in introductory phrases like “we respectfully submit”. I never answer like that. Many times the comment letter asks you to enhance your disclosure in the future. Unless the suggestion has some fundamental error in it (which I have never found in any comment letter I have received), the correct response is to say that in future filings you will do what is requested. List out what was requested and what you agreed to. When the SEC asks for support for your current accounting, provide it in a straightforward manner. Your examiner will have several open files and comment letters they are responsible for. The more clearly you write and the more simply you write, the easier you will make it for them.

One final resource is the examiner themselves. Sometimes their questions are not very clear. You are allowed to call them up and talk to them. Like your written answers, you need to be careful what you discuss with them, but as I said earlier, they are not out to “get you”. They are limited in what they can answer. You cannot run a response by them, all responses must be submitted in writing and they can only respond in writing. However, they can clarify what a question means. You can call them and let them know that you are on a tight deadline for a filing and that you would appreciate them working as fast as possible. Sometimes it can help to have a personal relationship when they have to make a final call on an accounting item. If you are more than just text on paper, maybe something will go your way. I know that it even helps me to respond when I have a voice to go with the words on the paper.

Before you send in your response, give it one last read through. Make sure all responses follow the standard format of repeating their question and then responding. Make sure you are sure the questions are actually responded to. Double check the wording to make sure it is direct and clear. Make sure each one has enough detail but not too much that it clouds your answer. If you see an answer that disagrees with a disclosure request, ask yourself why you are not just agreeing to the additional disclosure. Sometimes if you agree then you are actually agreeing to accounting that you do not think is right, but normally fighting over disclosure requirements is just not worth it.

There is an almost certain chance that you will receive another comment letter on your responses that focus on the questions that either were not fully answered or where the examiner disagrees with you or feels that there is insufficient support for your answer. If they disagree, then you are starting to have a problem. You need to be extremely careful with any question in the second set of comments because those are the ones that the examiner is most interested in.

Hopefully you will make it through the response process with nothing more than agreeing to improve disclosures in future filings. Don’t forget to actually improve disclosures when you agree to it. It should be part of your reporting checklist to ensure that you disclose what you agreed to and how you agreed to.

Share this: